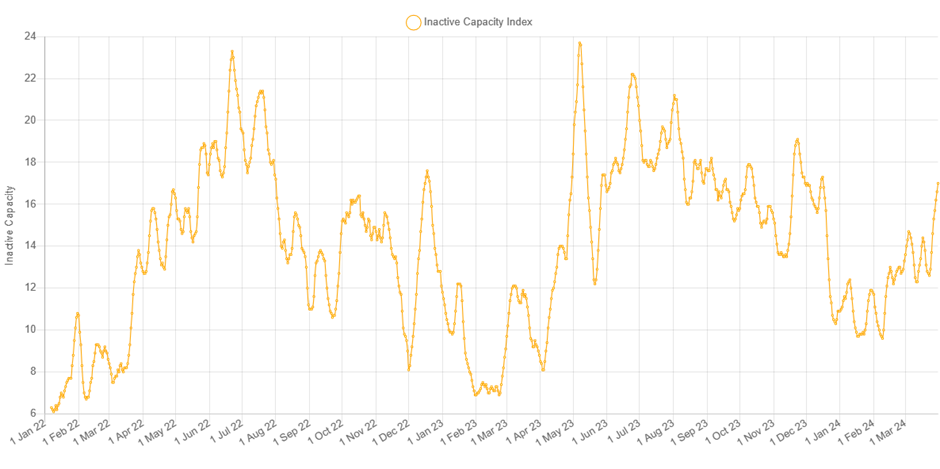

11 April 2024 – London – Latest data from Earth-i‘s SAVANT real-time global copper monitoring index shows that an average of 12.5% of global copper smelter capacity (covering 90% of the world total) was inactive in the first quarter of 2024, up from a more usual 9.3% and 8.7% in the same period of 2023 and 2022 respectively. That number was also higher than the already elevated 11.5% average registered in the first two months of the year.

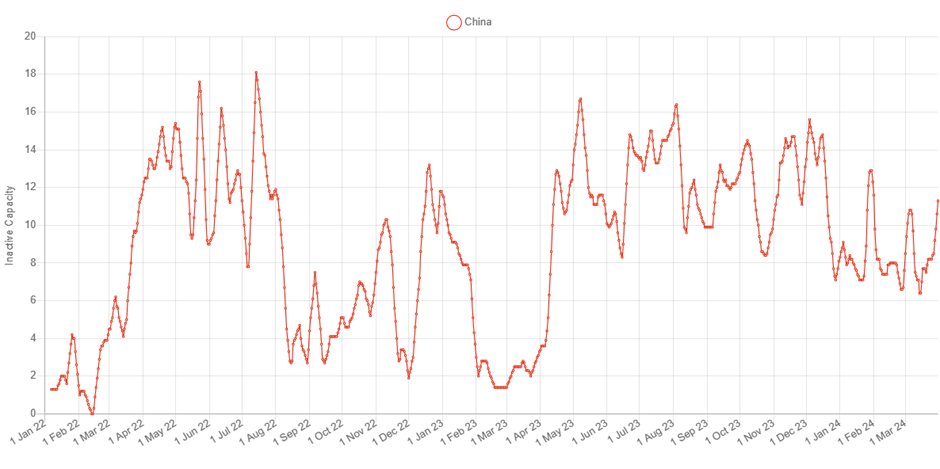

The increase was due largely to developments in top producing nation China, where inactivity rose to an average of 8.5%, compared with 4.1% in Q1 2023 and 4% in Q1 2022. In March alone, inactivity in China was around 9% while it stood at 17.7% on a global basis.

More significantly, as market watchers seek confirmation of pledged curtailments in China by the influential Copper Smelter Purchase Team, inactivity in the country jumped sharply in the final days of March, ending the month at a substantially higher 12.8%. April figures must be watched closely to establish whether this is a trend that will be sustained.

Significantly, we are now entering a period of several scheduled maintenance closures, and this is expected to help ease the tight concentrate supply situation which has helped to depress smelter treatment charges (TCs) and by extension smelter profitability.

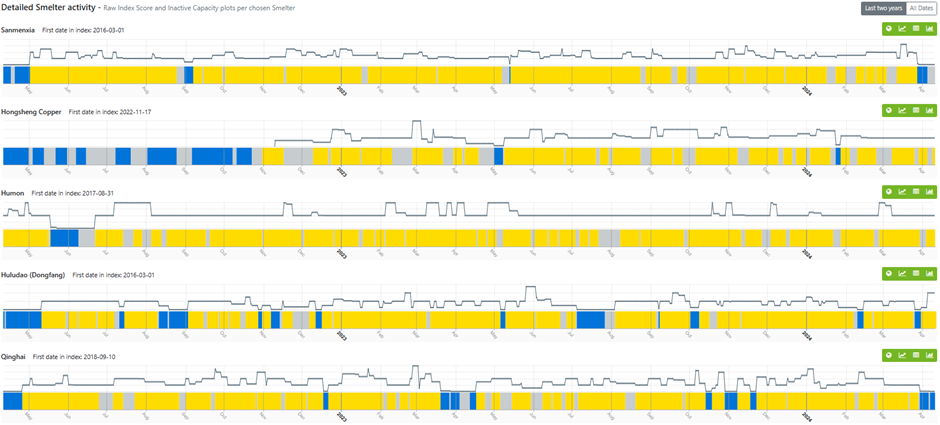

Latest SAVANT observations indicate that the Zhongyuan Gold Smelter (Sanmenxia) started to show inactive at the end of March, in line with its expected maintenance window. Other maintenance closures were expected at the Hongsheng and Humon plants this month, but the facilities were not showing as inactive at time of writing. Meanwhile the Huludao facility was due to close for two weeks from mid- to end-February, but SAVANT data pointed to a shorter outage period. The Qinghai facility also became inactive at the end of March, in line with its usual annual maintenance as shown by SAVANT data over previous years.

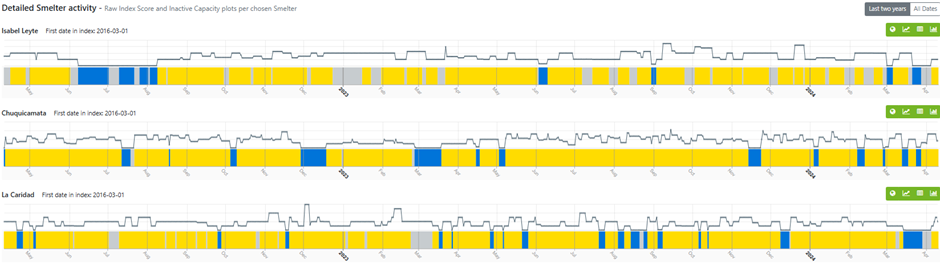

Outside China, the Isabel plant in the Philippines has shown flickers of inactivity, along with Codelco’s Chuquicamata smelter in Chile, with a two-week shutdown also indicated at Grupo Mexico’s La Caridad operation in Mexico.

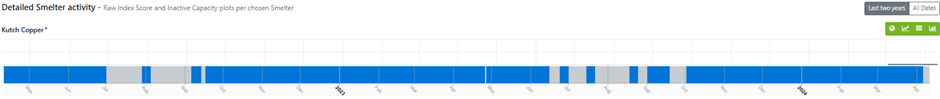

On the other hand, various recent reports state that the 500,000 tonnes per year (tpy) greenfield Adani smelter-refinery (Kutch Copper) in India has started up and produced its first cathode. At present the smelter is excluded from SAVANT calculations and will only be included when fully up and running. But our observations do not yet detect smelter activity, which may simply be due to high cloud coverage from the start of April or it may suggest that full-scale smelting operations are not quite underway yet.

Trade Data Monitor figures show that India’s imports of copper ores and concentrates have been elevated at more than one million tonnes in the past couple of years, but they were slightly lower year-on-year in January 2024. Peru and Panama had been identified as key suppliers of concentrate to the Adani smelter, but the Cobre de Panama mine is closed and neither country exported raw material to India during the month, with Indonesia and Chile instead the main suppliers.

The Inactive Capacity Index is derived from binary observations of a smelter’s operational status as being either active or inactive. The capacity weighted global and regional indices show the percentage of smelter capacity that is inactive, with readings displayed in the chart below as a weekly rolling average. A reading of zero would indicate 100% smelting capacity.

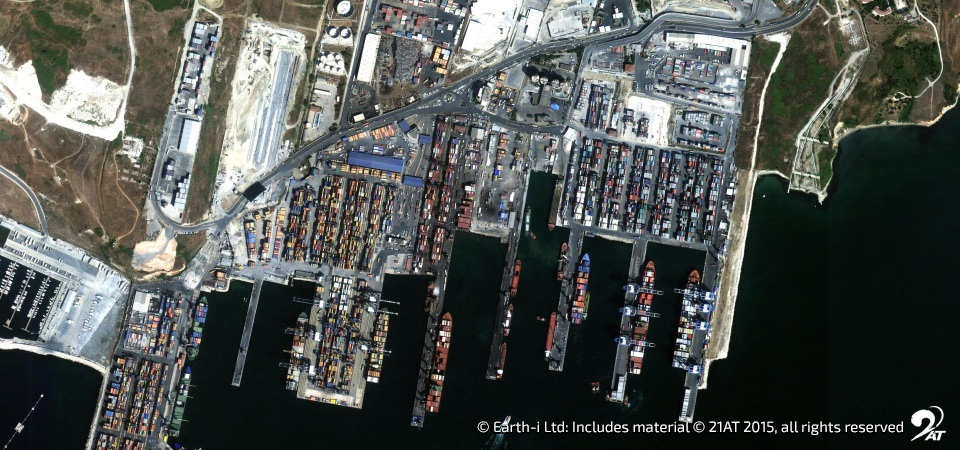

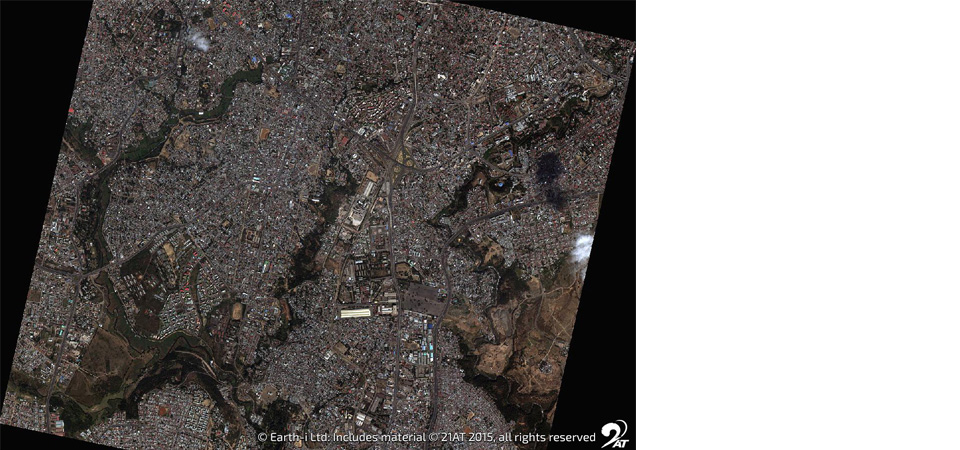

The SAVANT platform monitors up to 90% of the smelting capacity for copper, nickel and steel around the globe. Using daily updated sources, including extensive use of geospatial data collected from satellites, the index reports on the activities at the world’s smelting plants offering subscribers unprecedented levels of coverage, accuracy and reliability. This dataset allows users to make better informed and more timely trading decisions.

Sign-up here for a trial of the SAVANT service.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

Website: www.earthi.space / LinkedIn: Earth-i