5 June 2023 – SAVANT, the unique geo-spatial analytics product launched in October 2019 by Earth-i and Marex, covers global smelting activity for both Copper and Nickel.

– EMEA and Asia (ex China) copper & nickel dispersion indices remain weak –

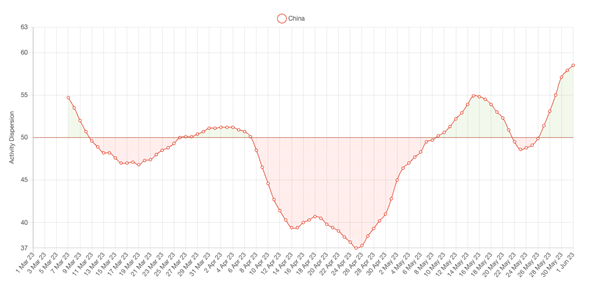

– Increasing number of China copper smelters back online –

– N & S America Copper Dispersion Indices record averages of 53.8 and 51.8 –

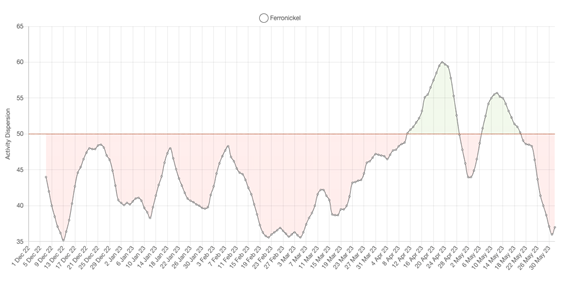

– China NPI Dispersion Index rebounded strongly to 47.1 from 37.9 in April –

May 2023 Copper observations include:

The Global Dispersion Index rose to 46.2 from 44.0 in April, the first month-on-month rise this year. While the Global Inactive Capacity Index also rose on average for May, this masks a significant differentiation between the two halves of the month. After recording the highest reading in almost five years on May 6th at 25.6%, the Global Inactive Capacity Index quickly fell back to finish the month at only 14.3%. This was largely driven by changes in smelting activity in China, where the country-level Inactive Capacity Index fell back from 17.4% on May 8th to 9.3% on May 31st. Despite this, it is interesting to note that Daye’s 300kt/a smelter in Hubei province remains on an extended outage, while Zhongtiaoshan’s 50kt/a Shanxi smelter and Zijin Mining’s 150kt/a Qiqihar plant in Heilongjiang province were also seen offline at the end of the month. In contrast, Jiangxi Copper’s massive 900kt/a Guixi smelter in Jiangxi province saw smelting intensity ramp up over the month, helping to explain how both the Dispersion and Inactive Capacity Indices could rise simultaneously. Indeed the China Dispersion Index rose by 10.6 points from only 42.1 in April – its lowest reading since March 2018.

While China rebounded, weakness remained globally, with the the ex. China Dispersion Index falling by 3.3 points to 41.9, the lowest reading in over two years. Kazzinc’s 70kt/a Ust-Kamenogorsk smelter in Kazakhstan was observed inactive for the whole of the month, as was Rio Tinto’s 320kt/a Garfield smelter in Utah. Incidentally, the closure of Codelco’s 120kt/a Las Ventanas smelter at the end of May will see this operation now fall out of the South American Index.

- Global Dispersion Index rose to 46.2 in May from 44.0 in April, the first month-on-month rise this year

- This was despite Global Inactive Capacity rising by 4.1% to an average 17.4% for the month. A Global Inactive Capacity reading of 25.6% on May 6th – indicating that more than a quarter of observed total smelting capacity was inactive that day – was the highest single-day figure since July 2018

- Since then, smelting activity in China has seen an appreciable recovery, with the country-level Dispersion Index rising by 10.6 points to an average of 52.7 in May. This follows a reading of only 42.1 in April – the lowest in five years

- Of the other regions, only North and South America saw Dispersion Indices above the average of 50, recording averages of 53.8 and 51.8, respectively

Sign-up here for a trial of the SAVANT service or read the Nasdaq report card on Savant here: MGST Report Card.

May 2023 Nickel observations include:

The Global Dispersion Index fell back to 41.8 in May from 43.3 in April, despite a strong uptick in activity in China, where the country-level Dispersion Index rose to 47.1 from 37.9 the previous month. This was primarily driven by the largest smelters in Shandong, namely Jiangsu Delong’s 100kt/a and Shandong Xinhai’s 190kt/a, and despite half a dozen smelters in the north of the country being observed offline at the end of the month, believed to be suffering from poor margins due to falling NPI prices since the beginning of the year.

Outside of China, ferronickel operations continue to struggle due to increased competition from NPI and high electricity costs in Europe. Of the southern European operations, only Euronickel Industries’ 20kt/a plant in North Macedonia appears to have restarted following closures brought on by the war in Ukraine last summer.

- Global Dispersion Index fell to 41.8 in May, down from 43.3 in April and the 6th consecutive monthly fall

- The China NPI Dispersion Index rebounded strongly to 47.1 from 37.9 in April, although it has now recorded its fourth month this year below the average of 50

- Only the Americas Dispersion Index is above 50, recording an average of 50.8 for May. Europe & Africa remains the weakest region, with a Dispersion Index of only 34.1

- The ferronickel Dispersion Index fell back to 47.7 in May from 51.9 in April, which was its only reading since March 2021 above the average of 50

Sign-up here for a trial of the SAVANT service or read the Nasdaq report card on Savant here: MGST Report Card.

Dr Guy Wolf, Marex Global Head of Analytics, commented: “The rebound in copper and nickel smelting activity in China is noteworthy against the bearish macro environment that has seen rumours emerge of an impending stimulus package from the government. Indeed, copper demand will need to step up to meet supply as SAVANT data shows rising concentrate exports from South America are now being processed to metal. Together with increasing refined shipments from Africa, the supply side is starting to fire.”

China Activity Dispersion Index (7 day moving average), March 2023 – Present

Ferronickel Activity Dispersion Index (7 day moving average), December 2022 – Present

Source: SAVANT by Earth-i

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated daily to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

Sign-up here for a trial of the SAVANT service or read the Nasdaq report card on Savant here: MGST Report Card.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

Website: www.earthi.space

Twitter: @Earthi_

LinkedIn: Earth-i

About Marex

Marex is a diversified global financial services platform, providing essential liquidity, market access and infrastructure services to clients in the energy, commodities and financial markets.

The Group provides comprehensive breadth and depth of coverage across five core services: Market Making, Execution and Clearing, Hedging and Investment Solutions, Price Discovery and Data & Advisory. It has a leading franchise in many major metals, energy and agricultural products, executing around 38 million trades and clearing over 193 million contracts in 2021. The Group provides access to the world’s major commodity markets, covering a broad range of clients that include some of the largest commodity producers, consumers and traders, banks, hedge funds and asset managers.

Marex was established in 2005 but through its subsidiaries can trace its roots in the commodity markets back almost 100 years. Headquartered in London with 22 offices worldwide, the Group has over 1,300 employees across Europe, Asia and America.

For more information visit www.marex.com