11 September 2024 – London – With the majority of new copper processing capacity in the last 25 years coming from the build out of ‘custom’ smelters in China, this is an important cohort to monitor, commanding almost a third of all global capacity tracked by Earth-i’s SAVANT platform.

These smelters are so called because they do not get their concentrate feed from integrated mines upstream as ‘captive’ smelters do, but instead purchase them from miners on either spot or annual (‘benchmark’) contracts. Their economic value is therefore primarily derived from the fee they get for processing copper concentrates to metal (the treatment and refining charge, or ‘TC/RC’), with secondary revenue streams from the metal premium (typically a value of up to $150/t dependent on where the metal is located) and free metal (copper that they are able to recover in excess of what they pay the miner), as well as by-product sulphuric acid sales. As a group, smelters in China are therefore likely to be more reactive to prevailing market prices than say, those in Chile, where high fixed costs, strong labour unions and logistics ‘take or pay’ contracts serve to ensure that these captive smelters run pretty much regardless, unless there is a disruption to their feed source.

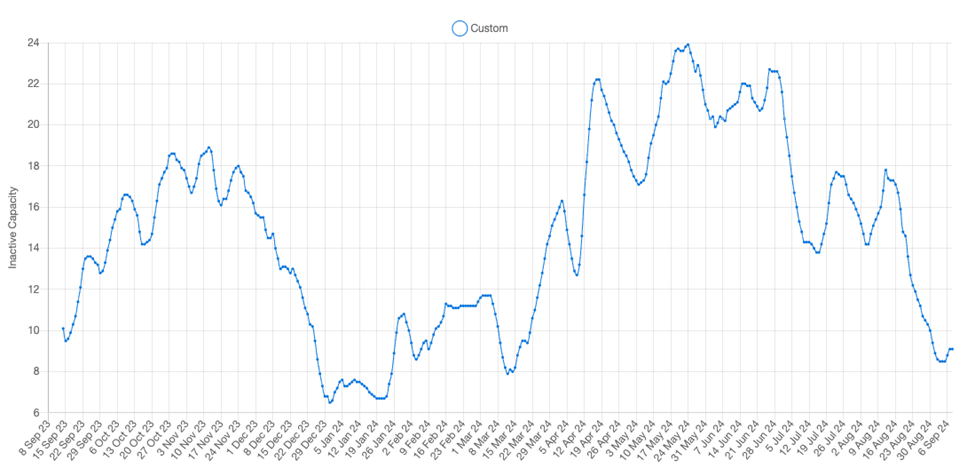

One of the most repeatable patterns that we have observed using the SAVANT platform is a seasonal rise in the inactivity series for custom smelters in September – October. There is good reason for this: in preparation for LME Week and the opening round of negotiations for the next year’s benchmark TC/RCs, custom smelters will try to ensure that prevailing spot TC/RCs are as favourable as possible, in order to anchor negotiations. As such they tend to reduce their activity to give the appearance of a ‘loose’ market so that there appears to be sufficient, or even surplus, concentrates available.

Chart 1: SAVANT Inactivity Index, custom smelters, September 2023 – Present

However this year is different. Due to a combination of generally underwhelming mine supply in 2023 and the shock suspension of the Cobre Panama mine in November that produced 330,000 tonnes of copper last year, together with the delivery of new smelting capacity, TC/RCs plummeted in Q1 2024 to record lows. This in turn provoked a response from the custom smelters, who brought forward and/or elongated maintenance stoppages in the traditional Q2 window, so that their inactivity index averaged more than 20% for the quarter – another record (see chart 1).

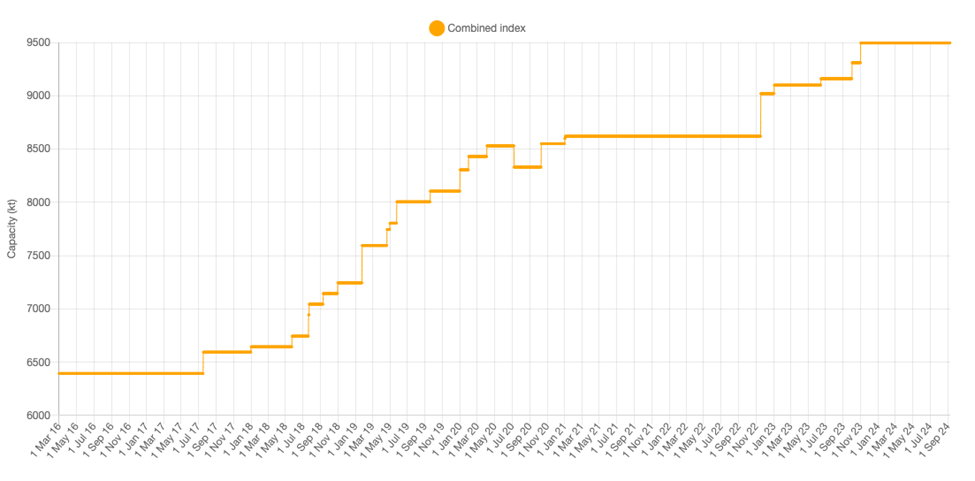

Nonetheless, according to latest data from the International Copper Study Group (ICSG), due to increased country level smelting capacity (see chart 2), Chinese refined production is still estimated to have risen by 7% in the first six months of 2024. As a result, they believe global refined supply increased by 811,000 tonnes ytd June, while at the same time demand only rose by 437,000 tonnes, so that the market has been in a surplus of close to half a million tonnes. This is important because it puts pressure on smelters’ other revenue streams – namely that derived from the premium for refined metal, which was close to zero in the Shanghai domestic market until recently, and also that from free metal as the market surplus has weighed on outright prices, which on the London Metal Exchange have fallen from a record $11,000/t in May to $9,000/t today.

Chart 1: SAVANT Inactivity Index, custom smelters, March 2016 – Present

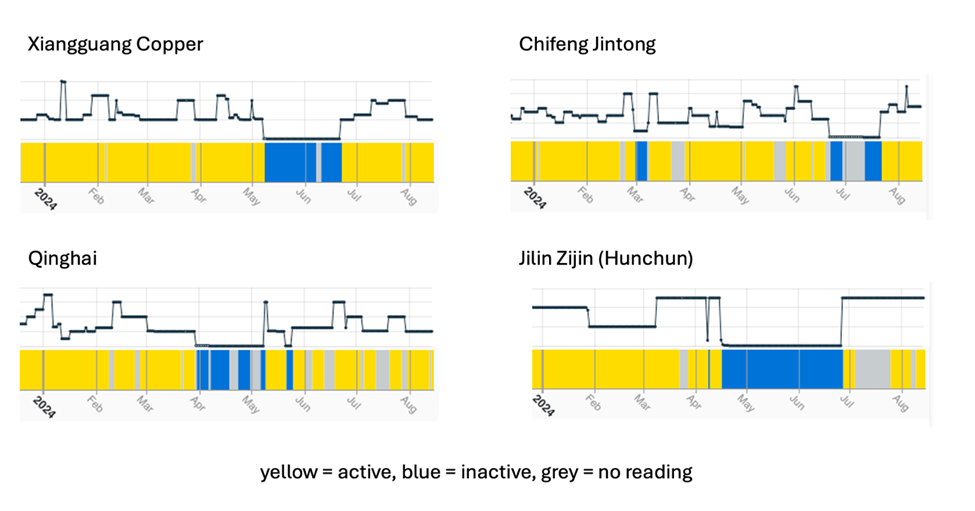

So although the rise in inactivity in Q2 put a floor under TC/RCs, with excess smelting capacity still competing for concentrates the inactivity series then fell sharply in July as plants including Qinghai, Jilin Zijin, Chifeng Jintong and Xiangguang returned to operation (see Chart 3).

Chart 3: SAVANT inactivity observations, selected Chinese smelters

Fast forward to today and after a brief period of relative stability, the inactivity series has once again plummeted since the middle of August, reaching a low of only 9% across the first week of September. And this speaks to the conundrum this year that each custom smelter faces in the lead up to LME Week at the end of the month: as a group, ‘playing dead’ might deliver a better outcome for the annual benchmark, ceteris paribus. But as an operator in competition for concentrates with others in the cohort, might they think that if they don’t secure raw material feed now they may not be able to survive what is still likely to be a record low benchmark anyway, if they are hamstrung to operate at a lower utilisation rate? On the other hand, if they do increase activity do they instead risk creating a vicious circle whereby not only will they set the stage for a lower benchmark TC/RC, but their ‘excess’ production into a surplus market will continue to undermine revenues from the premium and free metal?

SAVANT monitoring would indicate that they have chosen the latter path, so that it is every operator for themselves. Only time will tell if this proves to be the correct choice, however it would appear that such a course of action risks a race to the bottom that will inevitably claim casualties.

#CopperProduction #CopperSmelting #LMEWeek2024

If you would like to find out more about SAVANT and how you can subscribe, please email savant@earthi.space or call +44 (0)333 433 0015.

About SAVANT:

Earth-i’s SAVANT platform monitors up to 95% of the smelting capacity for copper and nickel around the globe and provides indicators of smelter activity and production around the globe, in an easy-to-understand format, covering multiple metals and minerals.

Data is collected and analysed using advanced algorithms derived from Computer Vision and Machine Learning techniques. Data is taken from several different Earth Observation satellites and our global and regional indices are updated at a high frequency to give consistent, insightful and dependable results.

Activity is scientifically measured using a consistent methodology. Over eight years of historical data is available.

About Earth-i:

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.