Global copper smelting increases in September conceals increased level of divergence across regions, whilst China’s Energy Consumption Control reductions hamper nickel activities

04 October 2021 – SAVANT, the unique geo-spatial analytics product launched in October 2019 by Earth-i and Marex, covers global smelting activity for both Copper and Nickel. September numbers show global copper smelting activity rose in September, although this masks a reduction in China and North America; while global nickel smelting shows a significant fall month-on-month, which was led by China and also increased inactivity in the Americas.

Sign-up here for the Free SAVANT service.

September 2021 Copper observations include:

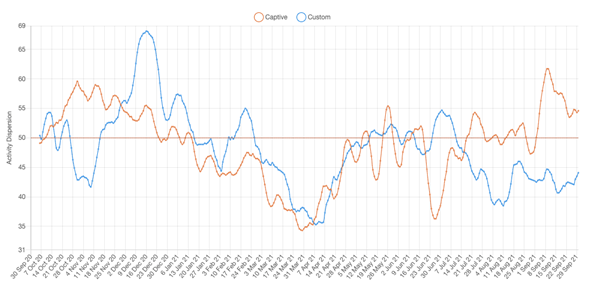

Smelting activities rose in September as TC/RCs in the spot market moved to a premium against annual benchmark terms at $59.5/t & 5.9c/lb, encouraging smelters to process material in addition to their contracted long term volumes. This was despite a drop in activity in China evident in the second half of the month, where escalating power restrictions appear to be increasing capacity curtailments. Congestion at the main border crossing to Kazakhstan will also now slow concentrate shipments to smelters in the southwest of the country. Meanwhile, activity in North America continues to be beset by problems, with four of the continent’s seven smelters experiencing periods of inactivity over the month.

- Global Dispersion Index averaged 49.3, up from August’s 45.9

- China Dispersion Index fell from 54.3 in the first 10 days of the month to 49.0 for the remaining 20 days

- The North American Dispersion Index fell back sharply to average 31.4 from 43.2 in August

- South American Inactive Capacity Index increased by over 25 points to 32.1 as one of the region’s largest smelters went on a 15 day maintenance shutdown

September 2021 Nickel observations include:

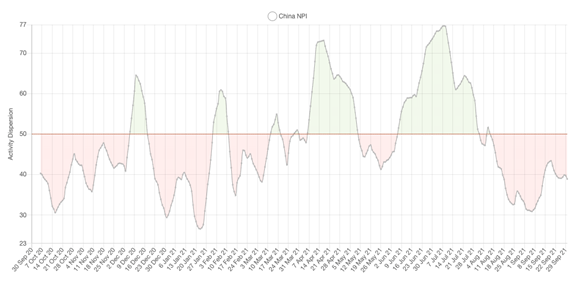

With the introduction of government mandated Energy Consumption Control reductions in China, local NPI activity fell back in September and will now also be hampered as the monsoon season in the Philippines reduces nickel ore shipments. At the same time activity indices in traditional producers Australia, Russia and New Caledonia are running below average levels. Meanwhile, in North America the restart of smelting operations following maintenance and strike action looks to be proceeding cautiously.

- Global Dispersion Index registered a second successive month below 50, falling to a monthly average of 41.1 in September from 48.1 in August

- NPI Dispersion Index in China fell again to average 37.8 in September

- The Americas Inactive Capacity Index jumped 10 points to an average of 49.6 in September

* – Index values go back to March 2016

Dr Guy Wolf, Marex’s Global Head of Analytics, commented: “At a global level we are seeing an increase in copper smelting activity as processors look to take advantage of resurgent TC/RCs, high sulphuric acid and bonus metal prices. However, as we approach LME Week, it is interesting to note that behind this lies something of a divergence in operating dynamics between custom and captive smelters. This provides a fascinating backdrop to the beginning of negotiations for next year’s annual benchmark terms, where both sides will be trying to argue for an improvement on this year’s $59.5 & 5.9c/lb.”.

The Activity Dispersion Index is a measure of capacity-weighted activity levels observed at smelter sites where a reading of 50 indicates that current activity levels are at average levels. Readings above or below 50 indicate greater or lesser activity levels than average, respectively. The above chart displays these readings as a weekly rolling average.

The Inactive Capacity Index is derived from binary observations of a smelter’s operational status as being either active or inactive. The capacity weighted global and regional indices show the percentage of smelter capacity that is inactive, with readings displayed in the chart below as a weekly rolling average. A reading of zero would indicate 100% smelting capacity.

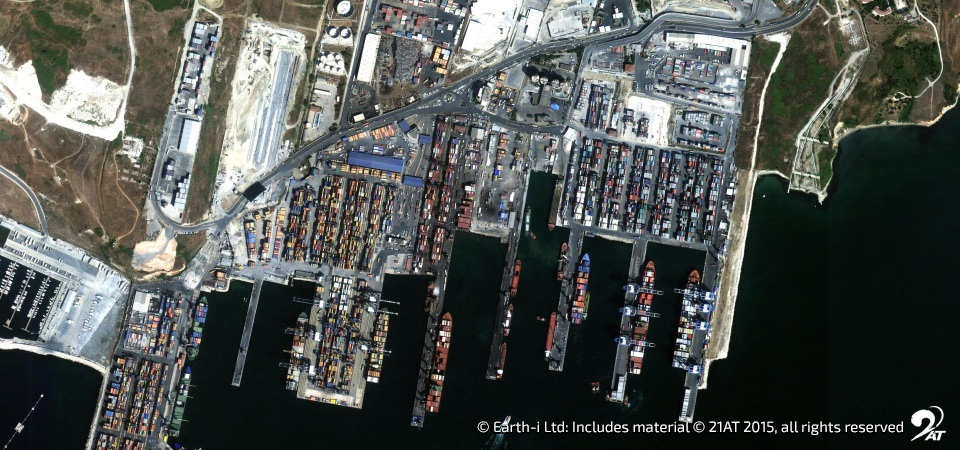

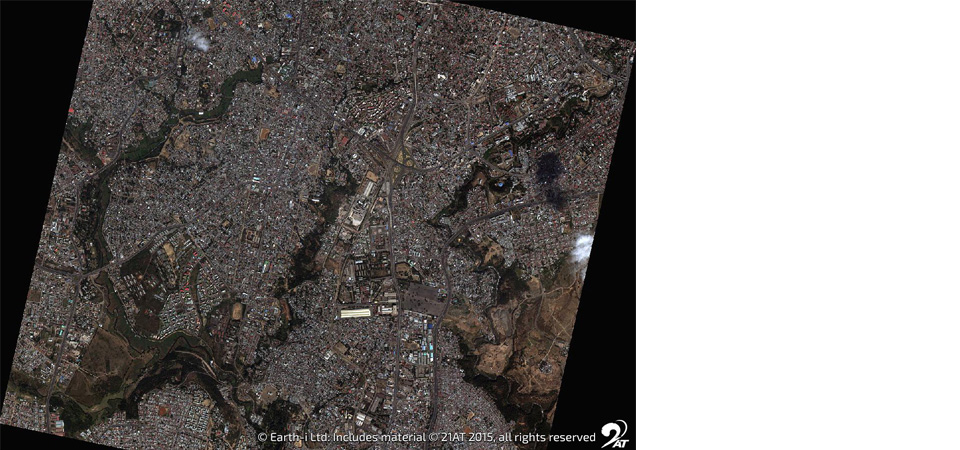

The SAVANT platform monitors up to 90% of Copper and 96% of Nickel smelting capacity around the globe. Using daily updated sources, including extensive use of geospatial data collected from satellites, the index reports on the activities at the world’s smelting plants offering subscribers unprecedented levels of coverage, accuracy and reliability. This dataset allows users to make better informed and more timely trading decisions.

To find out more please visit SAVANT, or sign-up for the Free SAVANT service.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

- Website: www.earthi.space

- LinkedIn: Earth-i

- Twitter: @Earthi_

To find out more please visit www.earthi.space.

For more information about this press release, please contact: info@earthi.co.uk

About Marex

Marex is a leading global commodities brokerage, with significant market share of many major Agricultural, Metal and Energy products. Headquartered in London, Marex’s extensive international network covers Europe, Asia and North America markets. State-of-the-art electronic and voice broking services facilitates all types of trading strategies. This is backed by decades of experience, with Marex placing great emphasis on intellectual knowledge and insight, alongside access to extensive data sets and the latest analytical tools. Its clients are commodity producers and consumers, banks, hedge funds, asset managers, brokers, commodity trading advisors and professional traders.

For more information visit www.marex.com.