CHINESE COPPER SMELTING ACTIVITY REMAINED SUBDUED IN AUGUST AS MAINTENANCE SHUTDOWNS CONTINUE

07 September 2021 – SAVANT, the unique geo-spatial analytics product launched in October 2019 by Earth-i and Marex, covers global smelting activity for both Copper and Nickel. SAVANT provides daily updates for global and regional indices, as well as national and intra-country indices. Sign-up here for the Free SAVANT service.

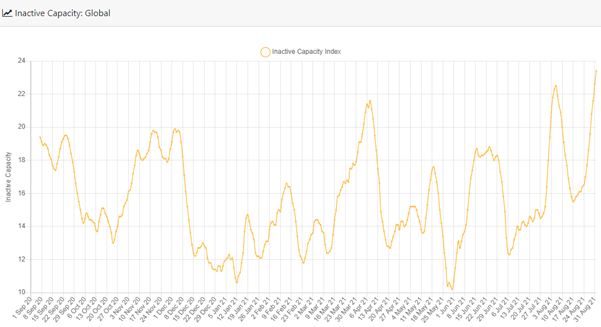

The SAVANT monthly release now also includes the Inactive Capacity Index, which is derived from binary observations of a smelter’s operational status as being either active or inactive. The capacity weighted global and regional indices show the percentage of smelter capacity that is inactive, with readings displayed in the chart below as a weekly rolling average. A reading of zero would indicate 100% smelting capacity.

August 2021 Copper observations include:

Despite a busy Q2 seasonal maintenance program, we are seeing extended downtime in July and August as – with concentrate shipments rising – processors choose to go offline now in expectation of higher TC/RCs later in the year. At the same time, we have seen a significant reduction in activity in South Central China, which we believe stems from recent flooding, while Chinese smelters more broadly are also being impacted by power restriction directives. Meanwhile, captive smelters in South America have been running at levels above global averages as integrated operations look to take advantage of elevated copper prices.

- Global Dispersion Index averaged 45.9, down from July’s 48.2

- China Dispersion Index averaged 44.6 in August, marginally down on July’s 46.4

- North American Activity Dispersion Index averaged 42.7, an increase on July’s 39.8, but was as low 25.5 in the middle of August

- South American Activity Dispersion Index averaged 62 for the month, up from 52.3 in July

- The Global Inactive Capacity Index rose to 19.2 on the back of increases in China, Asia & Oceania and Europe & Africa

- The China Inactive Capacity Index rose back to YTD highs at 13.9, from 10.5 in July, and the South Central China Activity Dispersion Index hit multi year lows at 17.6

August 2021 Nickel observations include:

With a number of large production sites experiencing disruptions ranging from flooding to labour strikes and civil unrest, the Global Inactivity Index has been rising since late May at a time of strong stainless-steel demand. This has led to a drawdown of inventories on the Shanghai Exchange to record lows, while prices have surged. With NPI activity in both China and Indonesia decreasing over the month, any change in momentum will likely need to come from more muted downstream demand.

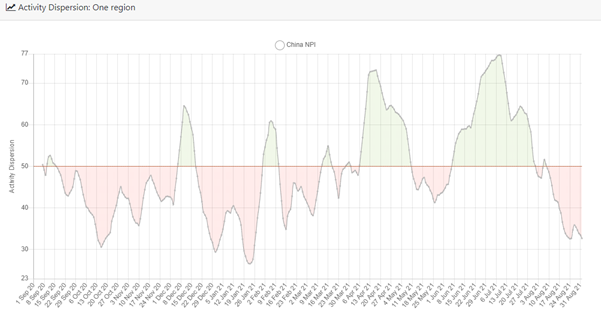

- The Activity Dispersion Index for Chinese NPI production fell back from 64.7 in July to 39.3 in August, having registered the highest reading in the last five years of 76.7 on July 8th

- The Indonesian NPI Activity Dispersion Index also fell to 42.2 and has now been below 50 for much of June, July and August

- The Global Inactive Capacity Index rose to YTD highs at 23.9 on August 31st

* – Index values go back to March 2016

Dr Guy Wolf, Marex’s Global Head of Analytics, commented: “Our more detailed analysis of the SAVANT data is starting to bear fruit as we further interrogate relationships to traditional series. For example, our observation that the China Inactivity Index for copper is potentially a leading indicator of the arbitrage between domestic and international pricing is exciting, as this presents an opportunity for our users to monetise the information. Similarly in North America, a user of the SAVANT platform would have been able to see that regional smelter activity has been well below average for much of the last 18 months, which together with snarled logistics networks, saw COMEX prices establish a record premium to those on the LME in late July”.

The Activity Dispersion Index is a measure of capacity-weighted activity levels observed at smelter sites where a reading of 50 indicates that current activity levels are at average levels. Readings above or below 50 indicate greater or lesser activity levels than average, respectively. The above chart displays these readings as a weekly rolling average.

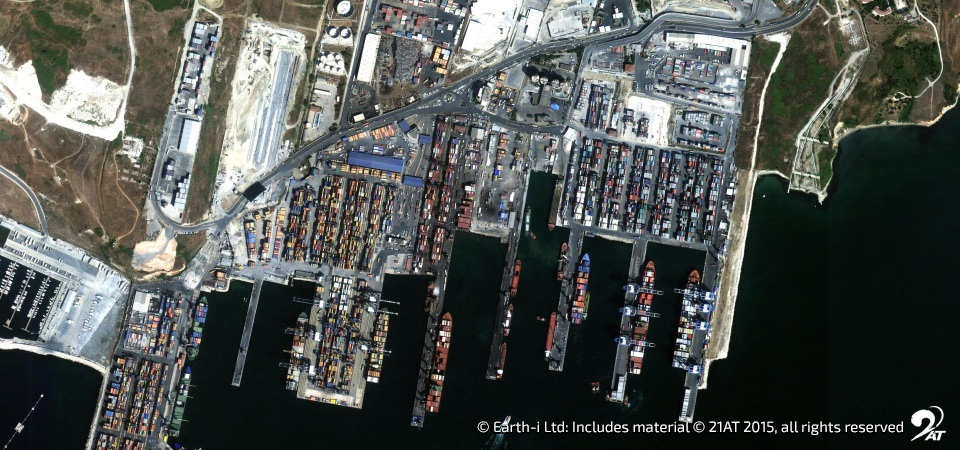

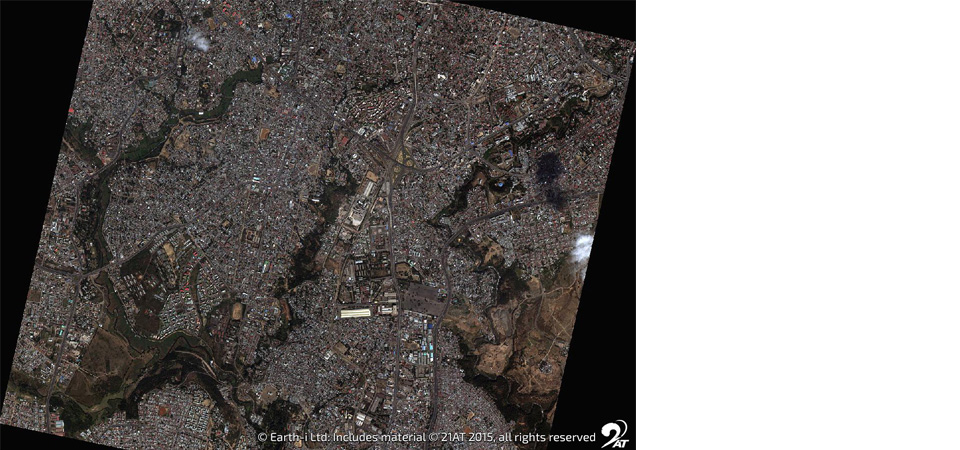

The SAVANT platform monitors up to 90% of Copper and 96% of Nickel smelting capacity around the globe. Using daily updated sources, including extensive use of geospatial data collected from satellites, the index reports on the activities at the world’s smelting plants offering subscribers unprecedented levels of coverage, accuracy and reliability. This dataset allows users to make better informed and more timely trading decisions.

To find out more please visit SAVANT, or sign-up for the Free SAVANT service.

About Earth-i

Earth-i is a geospatial intelligence company using machine learning, artificial intelligence and Earth Observation data to provide unique and relevant insights, derived from diverse geospatial data, that deliver clear decision advantage for businesses, governments and other organisations.

Earth-i provides advanced analytics using automated interpretation of a range of geospatial Earth Observation data sources including colour imagery, colour video, infra-red and radar from a range of sources including satellite, drone, aerial and ground-based sensors. This data is fused with additional data sources to extract factual understanding and generate predictive insights across a range of markets such as commodities, supply chain, agriculture, infrastructure and defence.

For more information visit:

- Website: www.earthi.space

- LinkedIn: Earth-i

- Twitter: @Earthi_

To find out more please visit www.earthi.space.

For more information about this press release, please contact: info@earthi.co.uk

About Marex

Marex is a leading global commodities brokerage, with significant market share of many major Agricultural, Metal and Energy products. Headquartered in London, Marex’s extensive international network covers Europe, Asia and North America markets. State-of-the-art electronic and voice broking services facilitates all types of trading strategies. This is backed by decades of experience, with Marex placing great emphasis on intellectual knowledge and insight, alongside access to extensive data sets and the latest analytical tools. Its clients are commodity producers and consumers, banks, hedge funds, asset managers, brokers, commodity trading advisors and professional traders.

For more information visit www.marex.com.